- R&D Tax Credits: What Are They?

- What qualifies as R&D?

- What expenses may my company claim?

- How far in the past can my company claim costs?

- What costs am I not eligible to claim?

- Which companies are eligible?

- Which initiatives qualify as R&D?

- Do distinct kinds of R&D exist?

- How much should I anticipate receiving?

- How will I get my claim paid?

- How much time does the entire process take?

R&D Tax Introduction

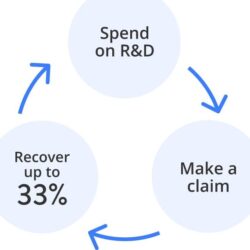

The government introduced Research and Development (R&D) tax credits in 2000 as a means of promoting and rewarding innovation in UK industry.

What counts as R&D?

A project with the express purpose of advancing science or technology

Unlimited Technical support

PHG Finance is available 24/7 to assist you with R&D Tax credits.

R&D Tax Credits: What Are They?

More than 39,000 UK businesses successfully filed for roughly £3.5 billion in tax relief last year. Many organisations, however, are still unaware that they are eligible for R&D tax credits and are losing out on money that could be used to expand their business and support innovation.