Any information reported externally needs to be accurate and dependable. This is what the request demands and now expects. Investors in particular are asking for further and further ESG information from companies – and not just around climate threat, there’s a focus in 2021 on governance and social issues similar as culture and diversity. Assurance provides an important part of structure that trust in what’s being bared. still, there’s no ‘ one size fits each ’ result to ESG assurance as it’s substantially determined by the pressures of your stakeholders or whether your backing authorizations it(e.g. ICMA Sustainability Linked Bond principles) but also where you’re on your ESG reporting trip.

What do we mean by Assurance?

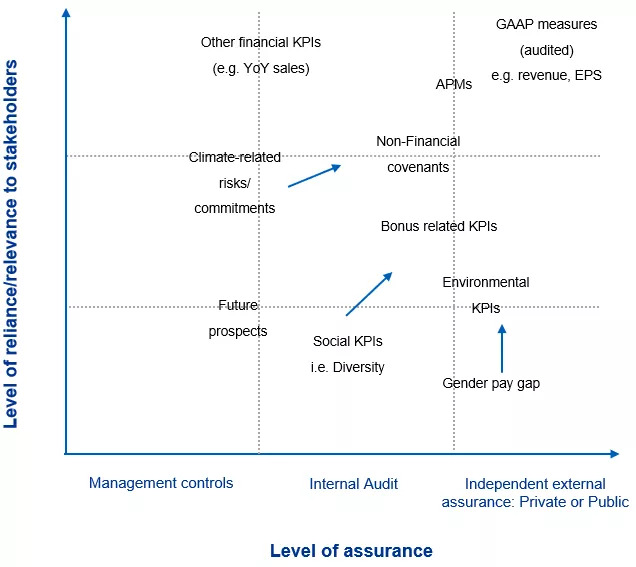

Assurance ranges from operation controls through to internal inspection up to external assurance opinions. The most extensively used external assurance standard fornon-financial information is ISAE 3000( UK) and ISAE 3410 for Greenhouse gas KPIs more specifically. The compass of independent assurance is either:

- Limited assurance –e.g. The opinion handed on a half- time review of fiscal statements is an illustration of a limited assurance

- Reasonable assurance –e.g. The opinion handed for an inspection of fiscal statements is an illustration of a reasonable assurance conclusion.

The difference is the position assurance you get which will guide the compass of what’s covered, and the quantum of testing trouble needed. At present, due to the relative childhood of ESG reporting and the cost/ benefit associated, utmost opinion are limited assurance. Whilst the compass of what’s covered for fiscal statement checkups and reviews are the whole statement and exposures, for ESG reporting utmost of the time it’ll be named KPIs or a specific section of the ESG report or periodic report. The Audit and Assurance Faculty of the Institute of Chartered Accountants in England and Wales( ICAEW) and the WBCSD issued a ‘ Buyer’s companion to assurance on non-financial information ’ that expands on the generalities of Assurance and an helpful reference.

What’s everyone else doing differently?

Our recent check revealed that of the top 100 companies( by profit) across 52 countries, 80 have reporting on ESG, and half of those reporting have gone a step further to seek assurance.

The UK results show that over 95 of our top 100 sample are reporting on ESG and of those companies, 61 attained assurance. And there’s good reason for this.

What are the benefits of getting Assurance?

Whilst external assurance remains voluntary in the UK, we’re seeing more and more bond/ loan/ installations that are linked to ESG KPIs that frequently bear the underpinning KPIs to be assured, especially since administrative remuneration now include ESG targets. Some marks will also anticipate that data is third- party vindicated and Internal checkups or operation verification won’t be sufficient.

As the matrix over shows, we anticipate that KPIs for which there’s a high position of reliance and/ or applicability to your stakeholders will need a advanced position of assurance, whether it’s public or private( i.e. just for the benefit of the board). We’re also seeing a shift for some KPIs(I.e. Climate related exposures) which preliminarily were only covered by operation controls or Internal inspection reviews but now are under the compass of External Assurance driven by the position of reliance and applicability to the stakeholders.

Green House Gas( GHG) emigrations are the substantially extensively reported metric, this is generally the go to compass for external assurance as the exposures presently sit in the Director’s report. There are veritably many full report assurance exemplifications(e.g. Stichting Pensioenfonds ABP) but a growing trend of mixed opinion i.e. reasonable assurance for GHG emigrations and limited assurance for other KPIs(e.g Air France KLM), that’s because companies are ready to put their GHG emigration KPIs though a advanced position of assurance and because the position of reliance is adding too.

Obtaining Assurance provides plenitude of benefits to the association, stakeholders and investors:

- It enhances credibility of what’s being reported;

- Challenges your association and pushes for further robust processes;

- Assurance brings less educated members of your platoon up to speed with the external reporting process;

- Brings an independent brace of eyes that can challenge and standard; and

- Prepares you for the increased focus on ESG reporting that’s likely to affect in obligatory assurance or full report assurance.

What should you do now?

For Q1/ Q2

1) Map your crucial KPIs to assess current of position of assurance gained vs materiality

still, I ’d encourage you to collude your crucial KPIs to assess the current position of assurance gained vs materiality – and that valid for all your Non-Financial KPIs, If not formerly done.

2) Address any critical gaps by engaging Internal Audit( IA) and external assurance

For any egregious gaps, engage internal resource to at least conduct end to end walkthroughs of the processes.

3) Report to the Audit Committee/ Board on your assurance approach and unborn road chart

It’s a trip – there are a cost/ benefit recrimination, engage with your AC to insure everyone is comfortable with the approach

For Q2/ Q34) Engage with external stakeholders to modernize your materiality assessment and apply any process and control advancements from internal inspection/ external assurance reviews

5) Review the content of your ESG reporting/ methodology statements to insure they’re up to date and fit for purpose for internal and external assurance

6) Plan for any pre- assurance/ readiness assessments in Q3 and Assurance for Q4

Pre-assurance are helpful to identify gaps and limit the costs of an assurance engagement or threat of getting a good assurance option.

For more information about ESG reporting assurance, Contact Us.

Comments (2)

Obila Doe

Our infrastructure management approach is holistic, addressing capacity monitoring, data storage, network utilisation, asset lifecycles, software patching, wired and wireless networking and more.

James Weighell

A hosted desktop solution allows for the delivery of a consistent and scalable IT experience for all users in an organisation. With this solution, users gain access via a desktop icon or link.